I strongly believe the Goods and Service Tax is a good idea.

I strongly believe the Goods and Service Tax is a good idea.

Yes, it will impact the poor more than the rich. Yes, it will cause the cost of living to increase at a time when most Malaysians are struggling to pay the bills.

But the people who will suffer the most aren’t the poor, it’s the tax-evaders. Tax evasion and illicit flows are a big problem for Malaysia, and the Goods and Service Tax is a straightforward and effective solution to that problem. GST is a closed loop sort of tax, which makes tax evasion much harder.

So enough of the GST choir, I’m sure you don’t agree, but that’s fine. In this great country of ours there should be room for dissent, except with Maslan, cause he’s so smart he must be right.

Output – Input

Let’s start with some basics on GST.

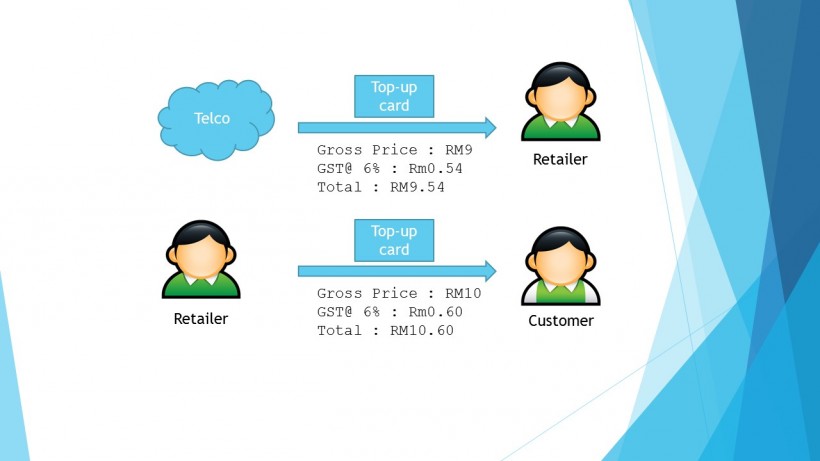

Imagine a top-up of RM10.Let’s assume that in a pre-GST Malaysia, the telco sold the top-up card to the retailer for RM9. The retailer sold it to the end customer for RM10, making a profit of RM1 per card.

In a post-GST world, the telco still sells the top-up card to the retailer for Rm9, but now adds 6% GST, making the total sale price from Telco to Retailer RM9.54. This additional Rm0.54 is called the input tax.

The retailer then sells the card to a customer at Rm10 plus 6% GST, making the final price Rm10.60. The additional Rm0.60 is called the output tax.

His Gross profit is Rm10.60 – Rm9.54 = Rm1.06. (stay with me here folks)

Now here’s the bit many don’t understand, the retailer doesn’t pay Rm0.60 to the government (even though that’s what he charges you), rather the retailer pays his output – input, or Rm0.60 – Rm0.54 = Rm0.06 . His gross profit of Rm1.06 becomes of nett profit of Rm1.00 after you deduct GST, which is exactly the same profit he had pre-GST.

The way this works is that the Telco pays Rm0.54 to the government (from their sale to the retailer), and the retailer then pays Rm0.06 to the government (from their sale to the customer). The end result is that the governments still gets Rm0.60 from the sale, but from two different entities at two different points of the supply chain.

This all lines up nicely, the problem is that customers are now paying Rm10.60 instead of Rm10. Let’s call this the RM10-Gross Model.

So now let’s make it a nett price of RM10

The complaint is that previously the prepaid cards were nice round numbers, Rm10, Rm20, Rm30. But Post-GST, they’ve become confusing sums like Rm10.60, RM21.20, and Rm31.80. It’s not just the confusion, it’s the coins and just the general hassle of dealing with these funny numbers. I also assume that the pre-paid market, particularly those still buying physical cards from shops, are predominantly cash based.

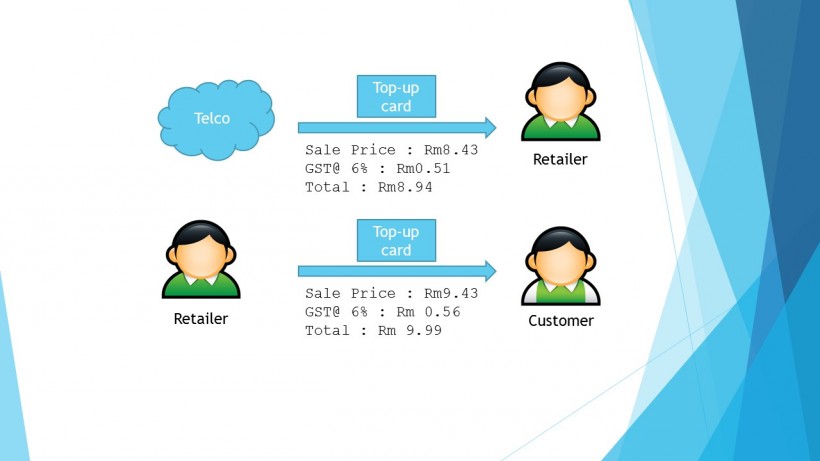

So let’s try to make it so that the NETT price paid by the customer is Rm10, instead of Rm10.60. We’ll call this the RM10-Nett model.

But how would that work?

Well, if you wanted to make it RM10 Post-GST, then you’d have to sell the top-up at Rm9.43 with 6% GST or Rm0.56, that would make it Rm9.99. No biggie, since with the 5 cent round-up rule, it would total to RM10 anyway (although the customer is being short-changed 1 cent).

Working back, you’d also have to make sure the retailer still makes Rm1 of profit, which means the telco now has to sell the card to the retailer at Rm 8.43 (instead of Rm9). The maths all adds up (trust me).

The customer would pay Rm10, and get Rm9.43 in credit for his phone bill, not much different than paying Rm10.60 now, and getting just Rm10.00 in credit. Just that in this way, the numbers are nice and round, and no hassle of coins.

But while this also fits in nicely, there’s a huge problem in implementing this solution

The solution is HARD

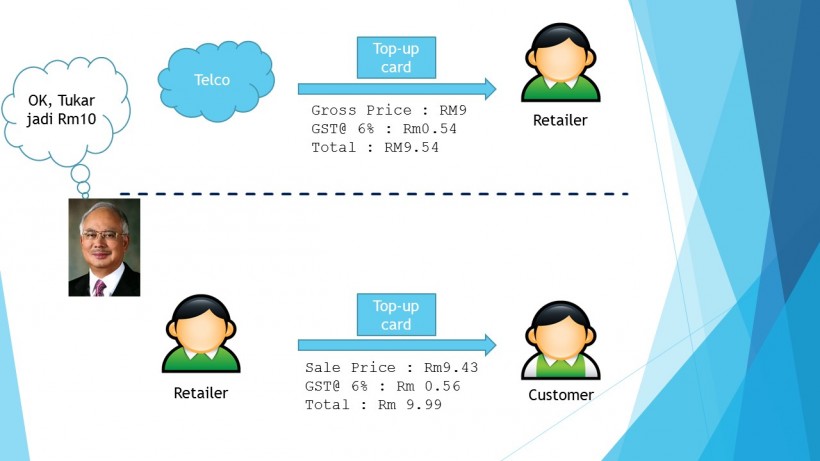

There’s a hitch because someone somewhere decided not to implement this on the 1st of April. If we did this from day one, they’d be less issue, but we’re well and truly into the GST implementation and now the problem is exponentially harder to address.

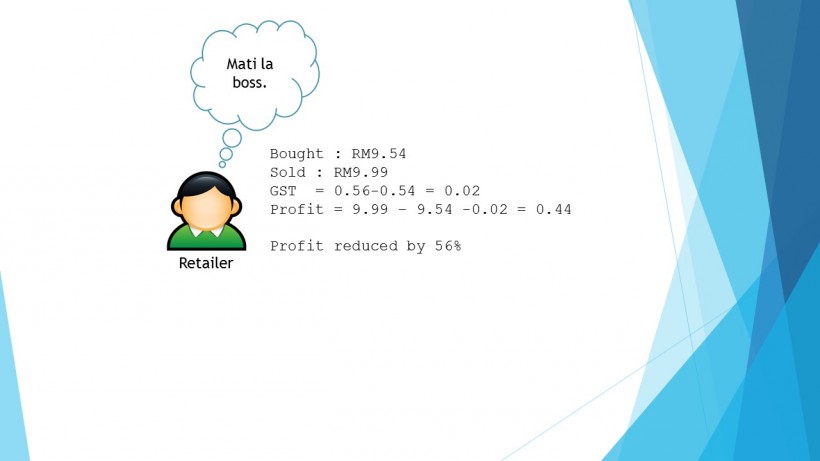

Retailers probably have a bunch of prepaid cards that they’ve purchased in April and haven’t yet sold, meaning these were cards that were procured at RM9.54,and planned to be sold at RM10.60. You can’t suddenly turn around and ask them to sell those cards at Rm10. The RM1 profit margin I put here is purely for easy calculation in reality the retailers profit is very minimal, and asking them to ‘absorb’ the GST would put them at a loss. You may not like retailers, but nobody wants to run a loss making business.

There is a solution, but it’s phenomenally difficult. The telcos would have to agree on a specific date when Rm10 becomes the nett price, and then they’d have to retroactively apply that to ALL their existing top-ups in the markets. In order not to leave retailers in the lurch, they’d need to issue credit notes to ‘modify the supply’ of the item, in essence issue them new tax invoices with the correct sales price, and then refund the retailers—it’s very very messy, and God knows how many retailers there are out there.

The example illustrates the telco selling directly to the retailer, typically that is not the case. There are multiple middle-men between the telco and the end customer, and that makes all the re-invoicing so much harder to do. Sort of the perfect storm of taxation invoicing nightmares.

This is even before we go into the question of whether the Telco’s have modified their systems to fully cope with the new pricing mechanisms. Telco billing systems are very very complex, and I doubt anyone from the IT department of the Telco’s would like to take on the task of ensuring that top-up values that were initially priced at Rm10, now become Rm9.43.

Can the Government make Top-Ups Zero rated

The Government has reserved the right to make certain items zero rated in order to keep their prices low. And while I consider it an essential item, I think it needs to be taxed, but there are still complications with making it zero rated.

For example, when you buy a Jusco Voucher, you can buy an Rm10 voucher for Rm10. No GST applicable, because the GST is applied when you actually cash in the voucher to buy something, and depending on what that is, it could be 0% of 6% GST. No problem there.

But when you ‘buy’ a top-up you’re not actually consuming it there and then, you may use it later, and you could use it for phone calls, data, IDD, spotify, buy special ringtones, buy some crappy looking MMS, etc. Nobody knows what you’re going to do with it until you actually do. You can’t make phone calls zero rated, but keep spotify standard 6%–the current top-up model does not support that. Because how would you apply the 6% tax on spotify but not on phone calls, how would you issue a tax invoice to the customer, the model can’t accomodate two different tax rates.

If you wanted to make phone calls zero rated, and mobile data standard 6% rated, telco’s would best create two accounts with two different pre-paid streams one for zero rated items and another for standard rated—but that would be a huge change to their systems, and not something we as consumers would like either, because it would make things far more complicated to work around.

And if you want to make mobile data zero rated, you’d have to make all forms of mobile data zero rated–and all forms of data as well. How would you differentiate P1 Wimax from Maxis Mobile?

The difference is, when you buy a voucher, the tax invoice is only issued when you cash in the voucher–and at that point decisions can be made, and logic can be applied depending on the item you’re cashing in it for.

When you buy a top-up the tax invoice is issued when you buy the top-up rather than when you utilize it, and it’s impossible to apply logic on some future decision the customer might make.

Other concerns

What happens if the retailer isn’t GST registered? Does he still charge GST, if he doesn’t they’ll probably lose money.

There’s also the problem of designated areas. In these designated areas, which disregards ‘output tax’. Quite confusing, what happens if you buy a pre-paid card from Langkawi, but utilize it in a non-designated area? How does that work? Don’t look at me, I’m just a blogger from Klang.

Also according to the Government guidelines, roaming charges should be zero rated–how does that work for prepaid numbers roaming? According to the Digi website, this is refunded–but how can Digi refund the GST, when it never charged you GST to begin with (GST was charged by the retailer who sold you the top-up). Too many questions, I don’t have the answer.

But the opposition says….

Tony Pua has come out and said the Government is helping unscrupulous telcos make money, and has even asked for the Government to bring down the full wrath of the Anti-Profiteering act on them.

Well, he has a point. In 2011, the Telco’s wanted to implement to pass on the Sales Tax charges to customers, but the Government intervened and said no. What eventually happened was that Pre-paid customers were charged no sales tax, while post-paid customers were. Not a very good solution.

But Telco top-ups are like Monopoly money, they have no real value other than the minutes of call you can use them for. When I started using pre-paid mobile phones back in 2001, calls could cost anywhere from Rm0.60 to Rm1.20 per minute, today 14 years later they cost at least 80% less. It’s hard to make a straight forward comparison because now they have things like flat-rates and peak periods and sms bundles, etc, but overall the cost of telecommunications has dramatically reduced over the last few years. I mean DRAMATICALLY.

GST is meant to be a transparent, and in order for it to be transparent it has to be paid by the customer. The true solution is to allow the telcos to compete, who cares if you’re paying 6% GST, but getting 20% more savings. And telcos are competing, there are a few tweaks we could do to get even more competitive, but things like Mobile Number Portability (that’s applicable even for pre-paid) are working in favor of the consumer to place pressure on the telcos to slash prices.

The reason telcos are raking in money, isn’t that their prices are skyrocketing, the price of oil in 2001 was Rm1.10, today it’s Rm2.00, but the price of a phone call has reduced more than the price of oil has increased. The reason they’re making money is that we’re buying more communications, 10 years ago I didn’t have a mobile data plan, today I have 3, and a fixed line connection, and a spotify subscription, and the list goes on and on. SMS’s may now cost 15 times less than 10 years ago, but who cares when the telco is charging me Rm75 for my mobile data.

This whole debacle is just a lack of forethought from the powers that be, who should have known their target market better.

Conclusion

I know this isn’t going to placate anyone, but the fact is, we’ve dug a hole waaaay to bloody deep now to think that addressing this question is going to be easy.

Plus, if you zero-rate it now, you still have to re-issue all those tax invoices which puts us back at square one. The minister needs to acknowledge that part of this is his fault, and the customs needs to shoulder some of the blame as well, but we all need to freaking move on.

Good analogy. Well written. Should the fund collected through GST is at better hands, Malaysia would have been as advanced as S.Korea. How unfortunate.

Good analogy. Well written. Should the fund collected through GST is at better hands, Malaysia would have been as advanced as S.Korea. How unfortunate.